Buying a home in Spain, especially in demand locations like the Costa del Sol, is an investment in lifestyle, wellbeing, and long-term value. But beyond the asking price, there are additional costs that can catch buyers off guard if not factored in from the beginning. One of the most important is the cost of signing the property deed.

Formalising the deed registration of the property is a legal requirement to register the property. It also involves a range of notary, tax and registry fees. Many buyers, both local and international, overlook this stage, yet it should form part of the total upfront investment when buying in Spain.

In this article, we provide a detailed explanation of what a property deed entails, including how to estimate the cost and associated expenses, with a focus on the Costa del Sol, where most of our projects are located.

What is a property deed?

Let’s start with the basics: the property deed, also known as the deed of sale, is the official legal act that formalises the sale in front of a notary.

It transforms a private contract between buyer and seller into a public legal document, which is required to register the home with the Land Registry. In short, signing the deed is a mandatory step if you want to become the official owner of the property.

This step is essential for two reasons:

- It provides legal security – The public deed helps prevent fraud and guarantees your ownership rights.

- It gives access to the registry – Without it, you can’t register the property or protect it against third parties.

What costs are involved in signing a title deed?

Here are the main costs associated with signing the deed of sale, which are generally paid by the buyer:

1. Notary fees

These fees are state-regulated and depend mainly on the value of the property. They usually range between 0.1% and 0.5% of the sale price.

Example: For a property priced at €700,000, notary fees could range from €700 to €3,500.

2. Taxes on new-build properties

When buying a new-build property in Spain, you’ll face two main taxes:

- VAT (IVA) – This is usually 10% of the purchase price.

- Stamp Duty (AJD) – A tax set by the autonomous regions, charged on certain notarial and legal documents. In Andalusia, the rate is around 1.2% of the registered price.

3. Land Registry fees

Registering the property isn’t legally required, but is strongly recommended. The fee varies based on property value. The base rate is €24.04 for properties with a value of less than €6,010.12. From this point onwards, there are different ranges of the property value and an additional €1.75 increase for every €1,000 of additional value:

- Up to €6,010.12 – €24.04

- €6,010.13 to €30,050.61 – add €1.75 per €1,000

- €30,050.62 to €60,101.21 – add €1.25 per €1,000

- €60,101.22 to €150,253.03 – add €0.75 per €1,000

- €150,253.04 to €601,012.10 – add €0.30 per €1,000

- Over €601,012.10 – fee continues on a sliding scale

4. Administrative fees

Although not required by law, it’s highly advisable to hire a gestor (property administrator) to handle paperwork, tax filings, and registration. This service generally costs between €300 and €600, depending on the complexity of the case.

How to calculate the deed cost of a property

The total cost of signing the deed depends on:

- Whether the property is new or a resale

- The purchase price

- The location, in prime areas like the Costa del Sol, costs tend to be higher

Example: Signing the deed on a luxury new-build villa in Marbella

Let’s take an international buyer purchasing a high-end villa in Marbella for €1,200,000.

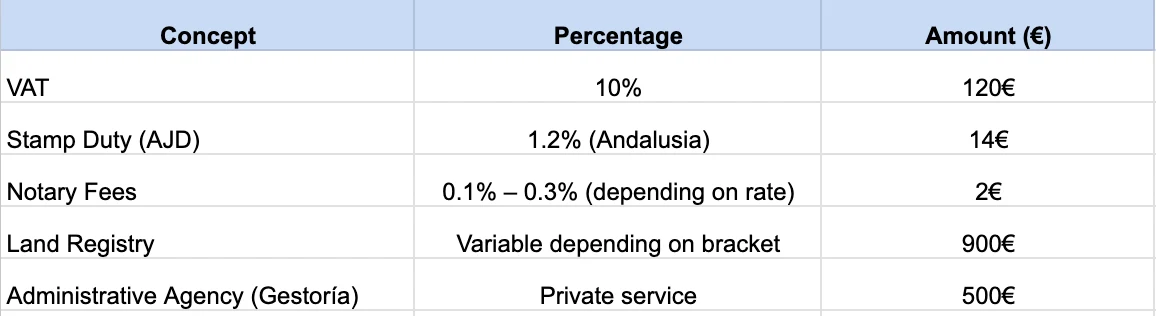

Since this is a first-sale property, VAT and AJD apply, along with notary, registry, and gestor fees. Here’s a breakdown of the estimated costs:

Estimated Total Deed Costs: €137,600

Property Price: €1,200,000

Approximate Deed Cost: €137,600

Percentage of Property Value: 11.47%

In cases where the purchase is financed with a mortgage, you’ll also need to account for additional expenses such as the property valuation, notary fees for the loan deed, mortgage registration, and any related insurance policies.

This example highlights just how important it is to understand and calculate the full cost of signing the deed, especially when buying a luxury property in prime locations like Marbella, where transactions often exceed one million euros.

Why work with a Real Estate consultancy like Prime Invest?

Signing the property deed in Spain — particularly in exclusive locations like the Costa del Sol — requires careful planning and a detailed understanding of the costs involved. Expenses for notary, taxes, registration, and administrator services can represent a significant portion of your overall budget.

That’s why it’s essential to work with real estate consulting, especially if you’re purchasing from abroad.

At Prime Invest, we offer international buyers a full-service approach that includes:

- In-depth market analysis

- Property scouting and opportunity identification

- Strategic advisory throughout the process

We publish our own updated market reports detailing price trends, available stock, and competitive dynamics by zone, helping you spot areas with strong growth potential. We also analyse residential developments and offer tailored recommendations on layouts, orientation, finishes and amenities, so you can make the right decision whether you’re buying for rental, resale or personal use.

In short, we bring years of experience helping international investors and lifestyle buyers secure peace of mind and lasting value in every step of the journey.

Ready to take the next step towards your new home with sea views? Get in touch and let’s make the process of signing your deed in Spain smooth and stress-free.